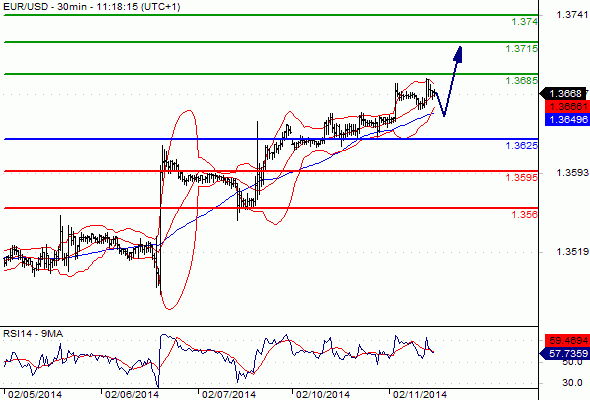

EUR/USD Intraday: the upside prevails.

Pivot: 1.3625

Most Likely Scenario: Long positions above 1.3625 with targets @ 1.3685 & 1.3715 in extension.

Alternative scenario: Below 1.3625 look for further downside with 1.3595 & 1.356 as targets.

Comment: The pair remains on the upside and is challenging its previous high.

GBP/USD Intraday: bullish bias above 1.638.

Pivot: 1.638

Most Likely Scenario: Long @ 1.639 with targets @ 1.644 & 1.6485 in extension.

Alternative scenario: Below 1.638 look for further downside with 1.635 & 1.631 as targets.

Comment: The pair remains on the upside and is challenging its resistance.

USD/JPY Intraday: the upside prevails.

Pivot: 101.9

Most Likely Scenario: Long positions above 101.9 with targets @ 102.65 & 102.9 in extension.

Alternative scenario: Below 101.9 look for further downside with 101.55 & 101.2 as targets.

Comment: The pair is rebounding above its support as the RSI is well directed.

AUD/USD Intraday: bullish bias above 0.899.

Pivot: 0.899

Most Likely Scenario: Long positions above 0.899 with targets @ 0.9045 & 0.9085 in extension.

Alternative scenario: Below 0.899 look for further downside with 0.8935 & 0.89 as targets.

Comment: the break above 0.899 is a positive signal that has opened a path to 0.9045.

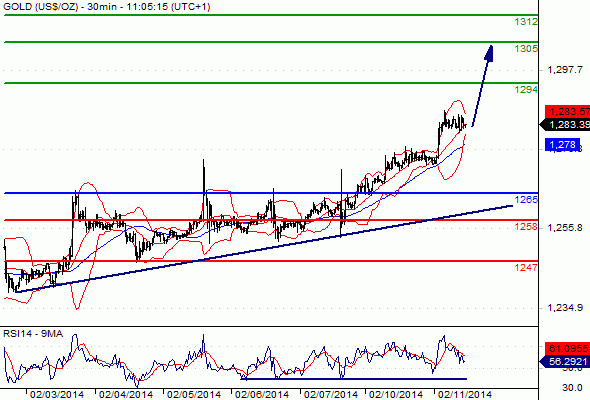

Gold spot Intraday: the upside prevails.

Pivot: 1265

Most Likely Scenario: Long positions above 1265 with targets @ 1294 & 1305 in extension.

Alternative scenario: Below 1265 look for further downside with 1258 & 1247 as targets.

Comment: technically, the RSI is above its neutrality area at 50.

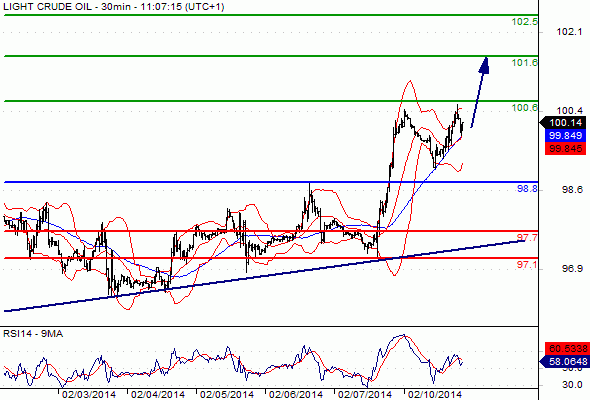

Crude Oil (NYMEX) (Mar 14) Intraday: the upside prevails.

Pivot: 98.8

Most Likely Scenario: Long positions above 98.8 with targets @ 100.6 & 101.6 in extension.

Alternative scenario: Below 98.8 look for further downside with 97.7 & 97.1 as targets.

Comment: the RSI is bullish and calls for further upside.

http://www.siamrichest.com/index.php/topic,100.0.html

http://www.siamrichest.com/index.php/topic,100.0.html

(Forex) วิเคราะห์ค่าเงินทางเทคนิค (ค่ำ) Forex Technical Analysis: EUR/USD, USD/JPY, GBP/USD, Gold

Pivot: 1.3625

Most Likely Scenario: Long positions above 1.3625 with targets @ 1.3685 & 1.3715 in extension.

Alternative scenario: Below 1.3625 look for further downside with 1.3595 & 1.356 as targets.

Comment: The pair remains on the upside and is challenging its previous high.

GBP/USD Intraday: bullish bias above 1.638.

Pivot: 1.638

Most Likely Scenario: Long @ 1.639 with targets @ 1.644 & 1.6485 in extension.

Alternative scenario: Below 1.638 look for further downside with 1.635 & 1.631 as targets.

Comment: The pair remains on the upside and is challenging its resistance.

USD/JPY Intraday: the upside prevails.

Pivot: 101.9

Most Likely Scenario: Long positions above 101.9 with targets @ 102.65 & 102.9 in extension.

Alternative scenario: Below 101.9 look for further downside with 101.55 & 101.2 as targets.

Comment: The pair is rebounding above its support as the RSI is well directed.

AUD/USD Intraday: bullish bias above 0.899.

Pivot: 0.899

Most Likely Scenario: Long positions above 0.899 with targets @ 0.9045 & 0.9085 in extension.

Alternative scenario: Below 0.899 look for further downside with 0.8935 & 0.89 as targets.

Comment: the break above 0.899 is a positive signal that has opened a path to 0.9045.

Gold spot Intraday: the upside prevails.

Pivot: 1265

Most Likely Scenario: Long positions above 1265 with targets @ 1294 & 1305 in extension.

Alternative scenario: Below 1265 look for further downside with 1258 & 1247 as targets.

Comment: technically, the RSI is above its neutrality area at 50.

Crude Oil (NYMEX) (Mar 14) Intraday: the upside prevails.

Pivot: 98.8

Most Likely Scenario: Long positions above 98.8 with targets @ 100.6 & 101.6 in extension.

Alternative scenario: Below 98.8 look for further downside with 97.7 & 97.1 as targets.

Comment: the RSI is bullish and calls for further upside.

http://www.siamrichest.com/index.php/topic,100.0.html