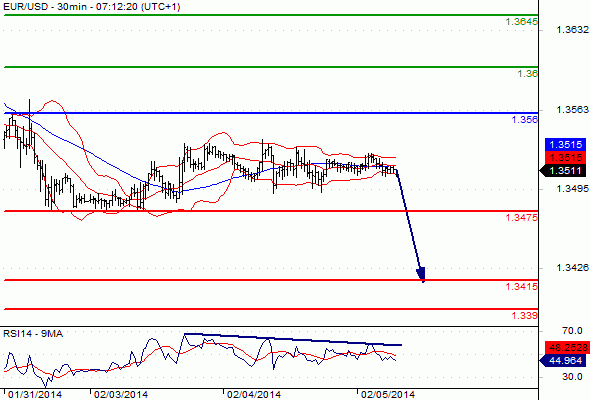

EUR/USD Intraday: key resistance at 1.356.

Pivot: 1.356

Our preference: Short @ 1.3515 with targets @ 1.3475 & 1.3415 in extension.

Alternative scenario: Above 1.356 look for further upside with 1.36 & 1.3645 as targets.

Comment: intraday technical indicators are lacking momentum but the 1.356 resistance maintains downside pressure.

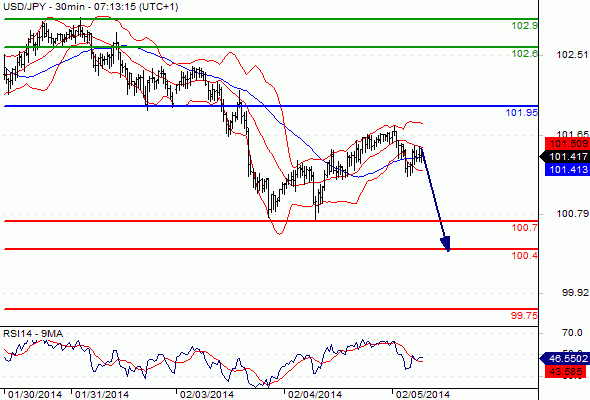

USD/JPY Intraday: key resistance at 101.95.

Pivot: 101.95

Our preference: Short positions below 101.95 with targets @ 100.7 & 100.4 in extension.

Alternative scenario: Above 101.95 look for further upside with 102.6 & 102.9 as targets.

Comment: as long as 101.95 is resistance, likely decline to 100.7.

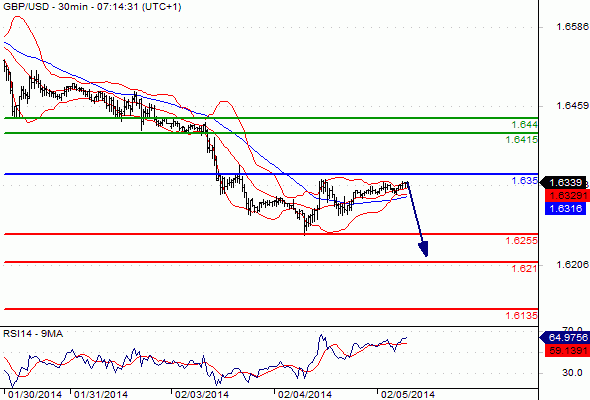

GBP/USD Intraday: key resistance at 1.635.

Pivot: 1.635

Our preference: Short positions below 1.635 with targets @ 1.6255 & 1.621 in extension.

Alternative scenario: Above 1.635 look for further upside with 1.6415 & 1.644 as targets.

Comment: as long as 1.635 is resistance, look for choppy price action with a bearish bias.

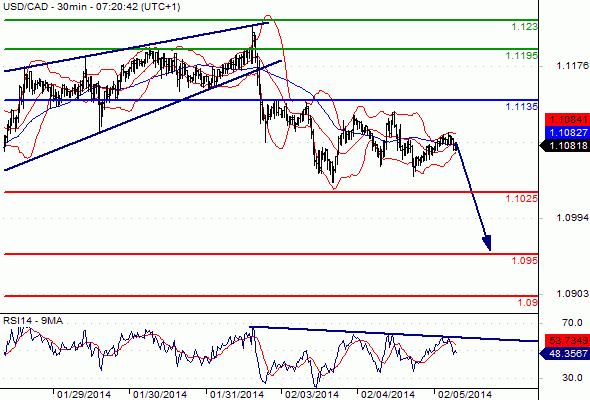

USD/CAD Intraday: key resistance at 1.1135.

Pivot: 1.1135

Our preference: Short positions below 1.1135 with targets @ 1.1025 & 1.095 in extension.

Alternative scenario: Above 1.1135 look for further upside with 1.1195 & 1.123 as targets.

Comment: the pair validated a Rising Wedge pattern calling for a down move.

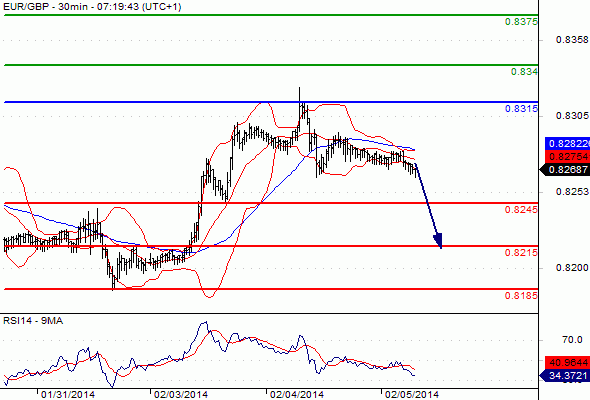

EUR/GBP Intraday: the downside prevails.

Pivot: 0.8315

Our preference: Short positions below 0.8315 with targets @ 0.8245 & 0.8215 in extension.

Alternative scenario: Above 0.8315 look for further upside with 0.834 & 0.8375 as targets.

Comment: as long as 0.8315 is resistance, look for choppy price action with a bearish bias.

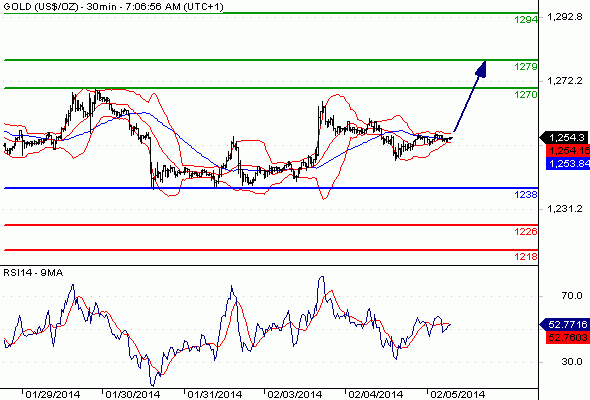

Gold spot Intraday: the upside prevails.

Pivot: 1238

Our preference: Long positions above 1238 with targets @ 1270 & 1279 in extension.

Alternative scenario: Below 1238 look for further downside with 1226 & 1218 as targets.

Comment: the RSI is mixed to bullish.

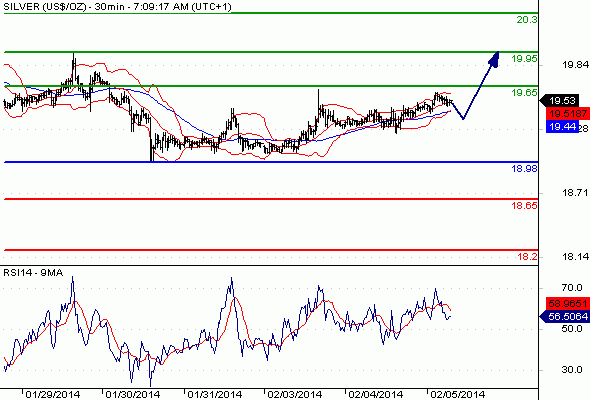

Silver spot Intraday: further advance.

Pivot: 18.98

Our preference: Long positions above 18.98 with targets @ 19.65 & 19.95 in extension.

Alternative scenario: Below 18.98 look for further downside with 18.65 & 18.2 as targets.

Comment: the RSI is mixed to bullish.

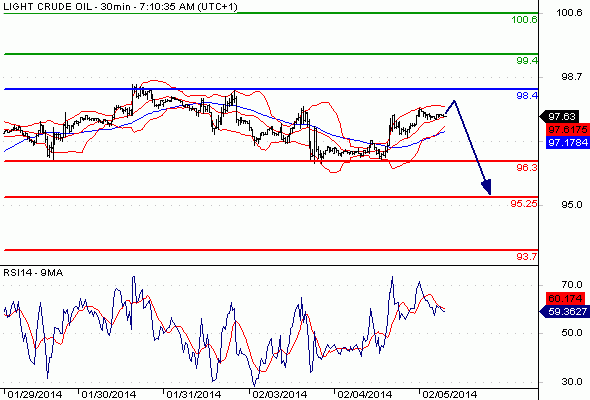

Crude Oil (NYMEX) (Mar 14) Intraday: key resistance at 98.4.

Pivot: 98.4

Our preference: Short positions below 98.4 with targets @ 96.3 & 95.25 in extension.

Alternative scenario: Above 98.4 look for further upside with 99.4 & 100.6 as targets.

Comment: as long as 98.4 is resistance, look for choppy price action with a bearish bias.

http://www.siamrichest.com/index.php?topic=51.0

http://www.siamrichest.com/index.php?topic=51.0

(Forex) วิเคราะห์ค่าเงินทางเทคนิค Forex Technical Analysis: EUR/USD, USD/JPY, GBP/USD, Gold

Pivot: 1.356

Our preference: Short @ 1.3515 with targets @ 1.3475 & 1.3415 in extension.

Alternative scenario: Above 1.356 look for further upside with 1.36 & 1.3645 as targets.

Comment: intraday technical indicators are lacking momentum but the 1.356 resistance maintains downside pressure.

USD/JPY Intraday: key resistance at 101.95.

Pivot: 101.95

Our preference: Short positions below 101.95 with targets @ 100.7 & 100.4 in extension.

Alternative scenario: Above 101.95 look for further upside with 102.6 & 102.9 as targets.

Comment: as long as 101.95 is resistance, likely decline to 100.7.

GBP/USD Intraday: key resistance at 1.635.

Pivot: 1.635

Our preference: Short positions below 1.635 with targets @ 1.6255 & 1.621 in extension.

Alternative scenario: Above 1.635 look for further upside with 1.6415 & 1.644 as targets.

Comment: as long as 1.635 is resistance, look for choppy price action with a bearish bias.

USD/CAD Intraday: key resistance at 1.1135.

Pivot: 1.1135

Our preference: Short positions below 1.1135 with targets @ 1.1025 & 1.095 in extension.

Alternative scenario: Above 1.1135 look for further upside with 1.1195 & 1.123 as targets.

Comment: the pair validated a Rising Wedge pattern calling for a down move.

EUR/GBP Intraday: the downside prevails.

Pivot: 0.8315

Our preference: Short positions below 0.8315 with targets @ 0.8245 & 0.8215 in extension.

Alternative scenario: Above 0.8315 look for further upside with 0.834 & 0.8375 as targets.

Comment: as long as 0.8315 is resistance, look for choppy price action with a bearish bias.

Gold spot Intraday: the upside prevails.

Pivot: 1238

Our preference: Long positions above 1238 with targets @ 1270 & 1279 in extension.

Alternative scenario: Below 1238 look for further downside with 1226 & 1218 as targets.

Comment: the RSI is mixed to bullish.

Silver spot Intraday: further advance.

Pivot: 18.98

Our preference: Long positions above 18.98 with targets @ 19.65 & 19.95 in extension.

Alternative scenario: Below 18.98 look for further downside with 18.65 & 18.2 as targets.

Comment: the RSI is mixed to bullish.

Crude Oil (NYMEX) (Mar 14) Intraday: key resistance at 98.4.

Pivot: 98.4

Our preference: Short positions below 98.4 with targets @ 96.3 & 95.25 in extension.

Alternative scenario: Above 98.4 look for further upside with 99.4 & 100.6 as targets.

Comment: as long as 98.4 is resistance, look for choppy price action with a bearish bias.

http://www.siamrichest.com/index.php?topic=51.0