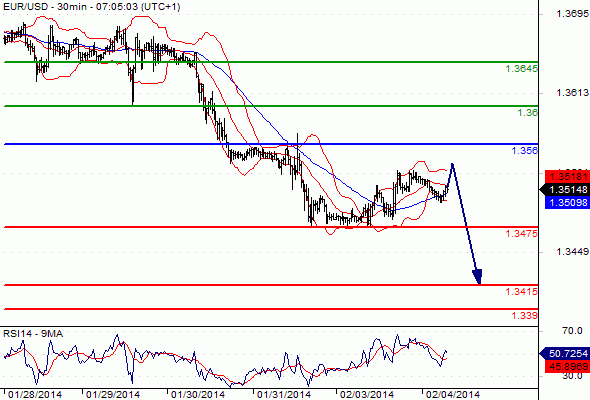

EUR/USD Intraday: key resistance at 1.356.

Pivot: 1.356

Our preference: Short positions below 1.356 with targets @ 1.3475 & 1.3415 in extension.

Alternative scenario: Above 1.356 look for further upside with 1.36 & 1.3645 as targets.

Comment: intraday technical indicators are lacking momentum but the 1.356 resistance maintains a downside pressure.

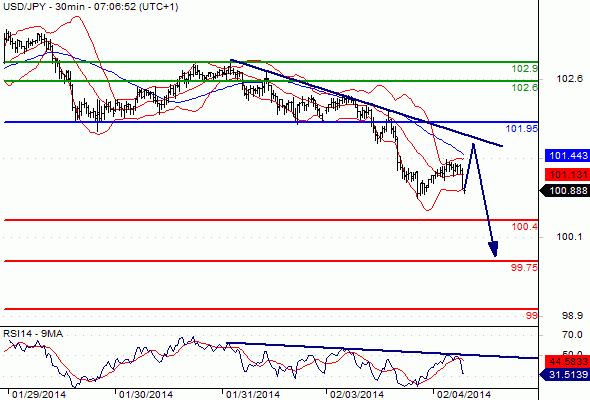

USD/JPY Intraday: capped by a negative trend line.

Pivot: 101.95

Our preference: Short @ 101.65 with targets @ 100.4 & 99.75 in extension.

Alternative scenario: Above 101.95 look for further upside with 102.6 & 102.9 as targets.

Comment: the pair and the RSI are capped by declining trend lines.

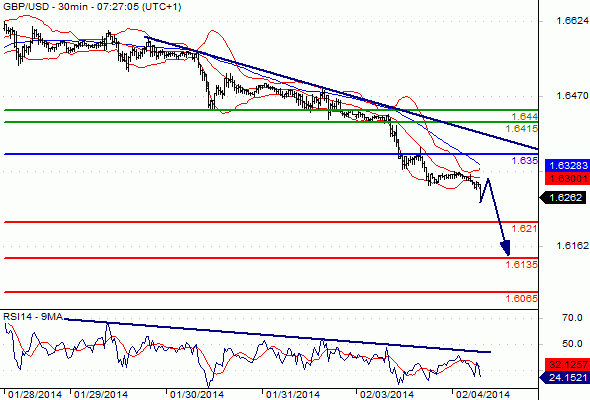

GBP/USD Intraday: the downside prevails.

Pivot: 1.635

Our preference: Short positions below 1.635 with targets @ 1.621 & 1.6135 in extension.

Alternative scenario: Above 1.635 look for further upside with 1.6415 & 1.644 as targets.

Comment: the RSI is capped by a declining trend line. In addition, the 50-period moving average (in blue) maintains a downside pressure.

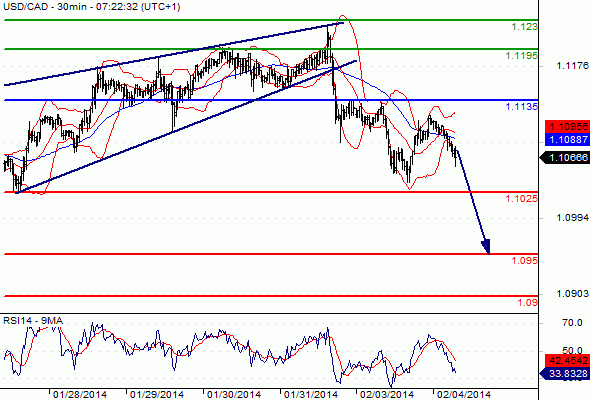

USD/CAD Intraday: key resistance at 1.1135.

Pivot: 1.1135

Our preference: Short positions below 1.1135 with targets @ 1.1025 & 1.095 in extension.

Alternative scenario: Above 1.1135 look for further upside with 1.1195 & 1.123 as targets.

Comment: the pair validated a Rising Wedge pattern calling for a down move.

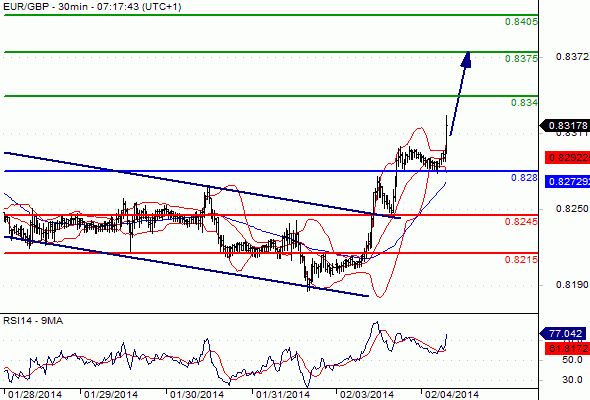

EUR/GBP Intraday: further advance.

Pivot: 0.828

Our preference: Long positions above 0.828 with targets @ 0.834 & 0.8375 in extension.

Alternative scenario: Below 0.828 look for further downside with 0.8245 & 0.8215 as targets.

Comment: the immediate trend remains up and the momentum is strong.

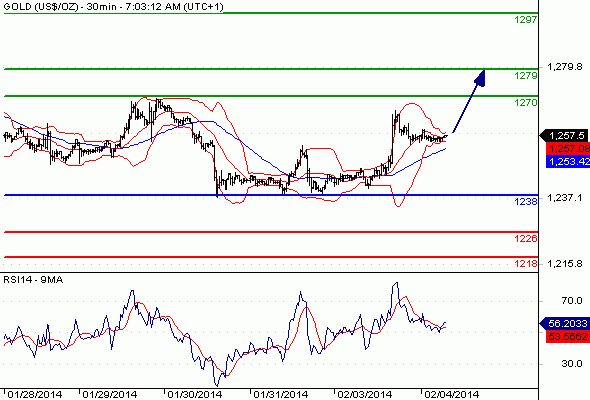

Gold spot Intraday: the upside prevails.

Pivot: 1238

Our preference: Long positions above 1238 with targets @ 1270 & 1279 in extension.

Alternative scenario: Below 1238 look for further downside with 1226 & 1218 as targets.

Comment: the RSI is mixed to bullish.

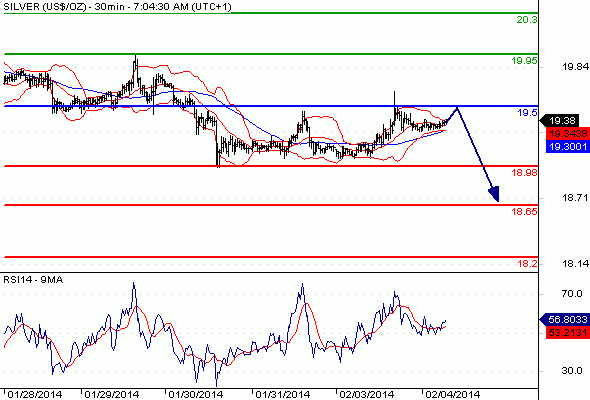

Silver spot Intraday: key resistance at 19.5.

Pivot: 19.5

Our preference: Short positions below 19.5 with targets @ 18.98 & 18.65 in extension.

Alternative scenario: Above 19.5 look for further upside with 19.95 & 20.3 as targets.

Comment: as long as 19.5 is resistance, look for choppy price action with a bearish bias.

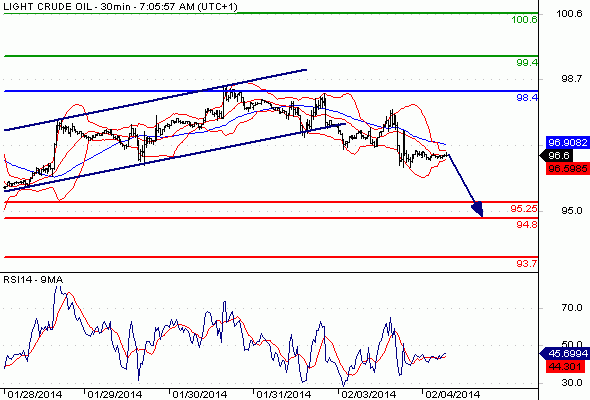

Crude Oil (NYMEX) (Mar 14) Intraday: under pressure.

Pivot: 98.4

Our preference: Short positions below 98.4 with targets @ 95.25 & 94.8 in extension.

Alternative scenario: Above 98.4 look for further upside with 99.4 & 100.6 as targets.

Comment: the RSI lacks upward momentum.

http://www.siamrichest.com/index.php?board=14.0

http://www.siamrichest.com/index.php?board=14.0

(Forex) วิเคราะห์ค่าเงินทางเทคนิค (ภาคค่ำ) Forex Technical Analysis: EUR/USD, USD/JPY, GBP/USD, Gold

Pivot: 1.356

Our preference: Short positions below 1.356 with targets @ 1.3475 & 1.3415 in extension.

Alternative scenario: Above 1.356 look for further upside with 1.36 & 1.3645 as targets.

Comment: intraday technical indicators are lacking momentum but the 1.356 resistance maintains a downside pressure.

USD/JPY Intraday: capped by a negative trend line.

Pivot: 101.95

Our preference: Short @ 101.65 with targets @ 100.4 & 99.75 in extension.

Alternative scenario: Above 101.95 look for further upside with 102.6 & 102.9 as targets.

Comment: the pair and the RSI are capped by declining trend lines.

GBP/USD Intraday: the downside prevails.

Pivot: 1.635

Our preference: Short positions below 1.635 with targets @ 1.621 & 1.6135 in extension.

Alternative scenario: Above 1.635 look for further upside with 1.6415 & 1.644 as targets.

Comment: the RSI is capped by a declining trend line. In addition, the 50-period moving average (in blue) maintains a downside pressure.

USD/CAD Intraday: key resistance at 1.1135.

Pivot: 1.1135

Our preference: Short positions below 1.1135 with targets @ 1.1025 & 1.095 in extension.

Alternative scenario: Above 1.1135 look for further upside with 1.1195 & 1.123 as targets.

Comment: the pair validated a Rising Wedge pattern calling for a down move.

EUR/GBP Intraday: further advance.

Pivot: 0.828

Our preference: Long positions above 0.828 with targets @ 0.834 & 0.8375 in extension.

Alternative scenario: Below 0.828 look for further downside with 0.8245 & 0.8215 as targets.

Comment: the immediate trend remains up and the momentum is strong.

Gold spot Intraday: the upside prevails.

Pivot: 1238

Our preference: Long positions above 1238 with targets @ 1270 & 1279 in extension.

Alternative scenario: Below 1238 look for further downside with 1226 & 1218 as targets.

Comment: the RSI is mixed to bullish.

Silver spot Intraday: key resistance at 19.5.

Pivot: 19.5

Our preference: Short positions below 19.5 with targets @ 18.98 & 18.65 in extension.

Alternative scenario: Above 19.5 look for further upside with 19.95 & 20.3 as targets.

Comment: as long as 19.5 is resistance, look for choppy price action with a bearish bias.

Crude Oil (NYMEX) (Mar 14) Intraday: under pressure.

Pivot: 98.4

Our preference: Short positions below 98.4 with targets @ 95.25 & 94.8 in extension.

Alternative scenario: Above 98.4 look for further upside with 99.4 & 100.6 as targets.

Comment: the RSI lacks upward momentum.

http://www.siamrichest.com/index.php?board=14.0