EUR/USD Intraday: the upside prevails.

Pivot: 1.3645

Most Likely Scenario: Long @ 1.366 with targets @ 1.3705 & 1.374 in extension.

Alternative scenario: Below 1.3645 look for further downside with 1.362 & 1.358 as targets.

Comment: The pair stands above its new support and remains on the upside.

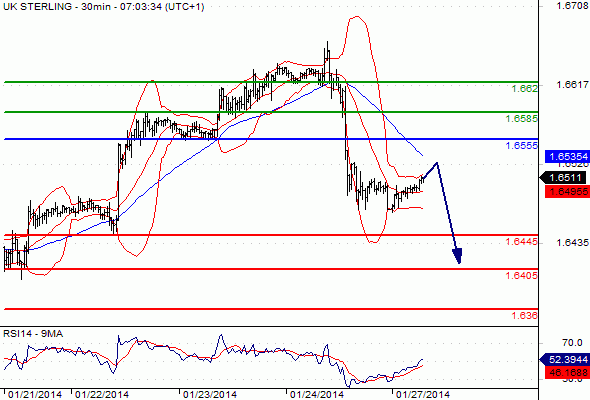

GBP/USD Intraday: under pressure.

GBP/USD Intraday: under pressure.

Pivot: 1.6555

Most Likely Scenario: Short positions below 1.6555 with targets @ 1.6445 & 1.6405 in extension.

Alternative scenario: Above 1.6555 look for further upside with 1.6585 & 1.662 as targets.

Comment: The pair is rebounding but stands below its new resistance.

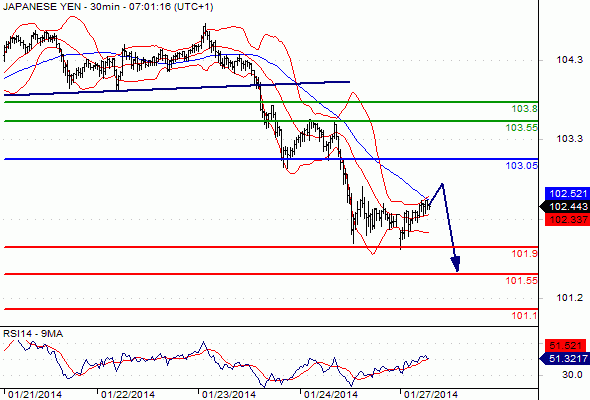

USD/JPY Intraday: under pressure.

USD/JPY Intraday: under pressure.

Pivot: 103.05

Most Likely Scenario: Short positions below 103.05 with targets @ 101.9 & 101.55 in extension.

Alternative scenario: Above 103.05 look for further upside with 103.55 & 103.8 as targets.

Comment: The pair is posting a rebound but stands below its resistance.

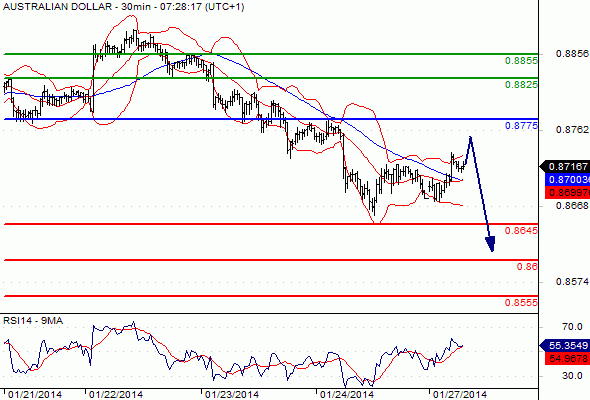

AUD/USD Intraday: under pressure.

AUD/USD Intraday: under pressure.

Pivot: 0.8775

Most Likely Scenario: Short positions below 0.8775 with targets @ 0.8645 & 0.86 in extension.

Alternative scenario: Above 0.8775 look for further upside with 0.8825 & 0.8855 as targets.

Comment: as long as 0.8775 is resistance, look for choppy price action with a bearish bias. The 0.8775 former support is now acting as a resistance.

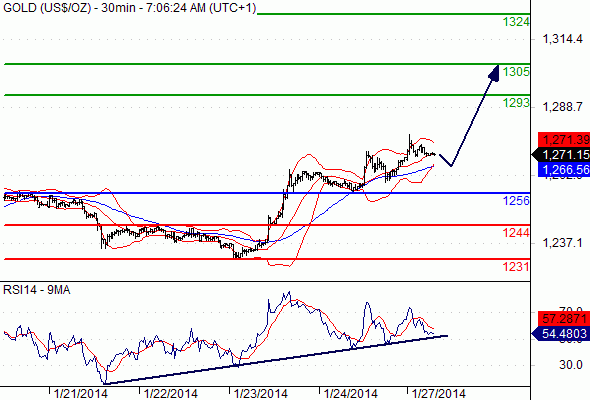

Gold spot Intraday: further upside.

Gold spot Intraday: further upside.

Pivot: 1256

Most Likely Scenario: Long positions above 1256 with targets @ 1293 & 1305 in extension.

Alternative scenario: Below 1256 look for further downside with 1244 & 1231 as targets.

Comment: the RSI is bullish and calls for further upside.

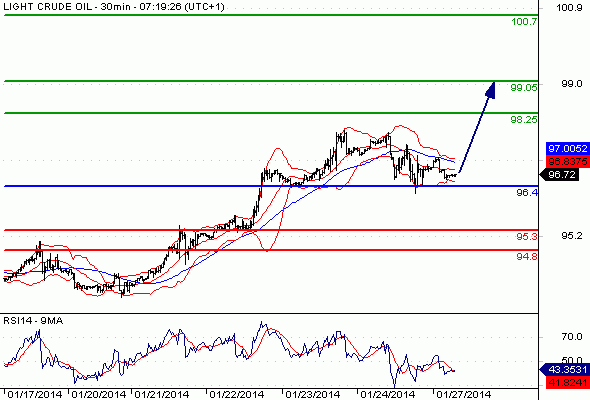

Crude Oil (NYMEX) (Mar 14) Intraday: caution.

Pivot: 96.4

Most Likely Scenario: Long positions above 96.4 with targets @ 98.25 & 99.05 in extension.

Alternative scenario: Below 96.4 look for further downside with 95.3 & 94.8 as targets.

Comment: a support base at 96.4 has formed and has allowed for a temporary stabilisation.

http://www.exnessthai.com

http://www.exnessthai.com

(Forex) วิเคราะห์ค่าเงินทางเทคนิค (ภาคบ่าย) Forex Technical Analysis: EUR/USD, USD/JPY, GBP/USD, Gold

Pivot: 1.3645

Most Likely Scenario: Long @ 1.366 with targets @ 1.3705 & 1.374 in extension.

Alternative scenario: Below 1.3645 look for further downside with 1.362 & 1.358 as targets.

Comment: The pair stands above its new support and remains on the upside.

GBP/USD Intraday: under pressure.

Pivot: 1.6555

Most Likely Scenario: Short positions below 1.6555 with targets @ 1.6445 & 1.6405 in extension.

Alternative scenario: Above 1.6555 look for further upside with 1.6585 & 1.662 as targets.

Comment: The pair is rebounding but stands below its new resistance.

USD/JPY Intraday: under pressure.

Pivot: 103.05

Most Likely Scenario: Short positions below 103.05 with targets @ 101.9 & 101.55 in extension.

Alternative scenario: Above 103.05 look for further upside with 103.55 & 103.8 as targets.

Comment: The pair is posting a rebound but stands below its resistance.

AUD/USD Intraday: under pressure.

Pivot: 0.8775

Most Likely Scenario: Short positions below 0.8775 with targets @ 0.8645 & 0.86 in extension.

Alternative scenario: Above 0.8775 look for further upside with 0.8825 & 0.8855 as targets.

Comment: as long as 0.8775 is resistance, look for choppy price action with a bearish bias. The 0.8775 former support is now acting as a resistance.

Gold spot Intraday: further upside.

Pivot: 1256

Most Likely Scenario: Long positions above 1256 with targets @ 1293 & 1305 in extension.

Alternative scenario: Below 1256 look for further downside with 1244 & 1231 as targets.

Comment: the RSI is bullish and calls for further upside.

Crude Oil (NYMEX) (Mar 14) Intraday: caution.

Pivot: 96.4

Most Likely Scenario: Long positions above 96.4 with targets @ 98.25 & 99.05 in extension.

Alternative scenario: Below 96.4 look for further downside with 95.3 & 94.8 as targets.

Comment: a support base at 96.4 has formed and has allowed for a temporary stabilisation.

http://www.exnessthai.com